Tags

#JournalOfAntiques #Collectibles #CrackleGlass #ArtGlass #Retro #Glass, #Retro, American Society of Appraisers, Antiques, Appraisers Association of America, art market, Auction, certified appraiser, Estate Appraisal

All it takes is one stream of light shining through your window to create a rainbow effect after it illuminated that bottle or vase sitting on your sill. Perhaps, this is the magic that keeps collectors returning to that local tag sale or flea market in search of another sparkling keepsake.

Vintage Blenko Crackle Glass Miniature Pitchers

Crackle glass, one of the most common collectibles, will produce such an effect from that stray sunbeam, leaving you dazzled without warning when displays of colored, refracted light fill your room. Created as far back as the 16th century, this dime-store dazzler had a resurgence in the 1950’s and reached it’s zenith in the 1960’s to complement the modern décor of the Madmen era. Bold or clear, shaded or iridescent, crackle glass was available in all varieties and price ranges to complement interior spaces and wallets. From inexpensive eye catchers to pricey floor standing vases, crackle glass was easily available because it is a treatment rather than a type of glass.

Vintage Ruby Crackle Glass

The ‘crackling’ finish is created when a hot glass object is submerged in cold water, a technique that can be applied to just about any type of sturdy glass. The abrupt temperature change creates a network of fine cracks in the glass leaving the light to deflect patterns of the irregular cracks on other surfaces.

Initially, crackle glass was hand blown, but quick popularity led to less-expensive moulded glass knockoffs. And, since any glass manufacture could utilized the crackling technique, almost every company created crackle glass, including Tiffin, Duncan and Imperial, but the most notable crackle glass firms were located in West Virginia. Especially noted for miniatures, Pilgrim, Rainbow, Kanwha and Bishoff, created those diminutive jugs, vases, and pitchers that typically adorn the interior of many households. But the master manufacturer of crackle glass was Blenko.

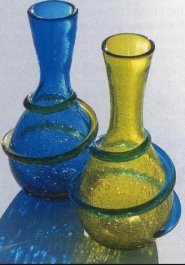

Blenko Crackle Glass Vases

Originally known for producing stained glass, Blenko expanded its glassware to include richly colored, oversized art glass vessels. After the market for stained glass bottomed out in the Depression of 1929, William H. Blenko, the son of the founder was forced to seek out other revenue sources and expanded glassware production to include affordable decorative housewares, including bottles and vases. Their past experience with manufacturing stained glass contributed to the vast color palette that forged Blenko’s reputation. In the mid 1940s, Blenko produced crackle glass miniatures, and by the 1960s large scale versions in both crackle and no-crackle finishes were available. The two prominent artisans for Blenko, Winslow Anderson (1947-1952) was noted for modern shapes and vivid colors, while Wayne Husted, the design director (1952-1963) was responsible for hundreds of designs produced during that period. Joel Philip Myers, Blenko’s design director (1963-1970), a skilled glass blower, was known for elongated forms, spirals, two-color and air twist stoppers.

Today, crackle glass collectors have an array of options to choose from including color, type and size of vessel. Others focus on a particular company or artist. Many of us, however simply collect crackle glass for its bargain prices, and ability to brighten even a cloudy day.

Resources: Journal of Antiques & Collectibles, Etsy

Image: Joan Miro’s “Blue Star”

Image: Joan Miro’s “Blue Star”